Mortgage Affordability Calculator Government Of Canada

As of July 9 2012 the maximum amortization period for mortgages with less than a 20 percent down payment. To help determine whether or not you qualify for a home mortgage based on income and expenses visit the Mortgage Qualifier Tool.

Find an estimate of how much mortgage or rent you can afford.

Mortgage affordability calculator government of canada. Financial tools and calculators. In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000. While every effort is made to keep this tool up-to-date CMHC does not guarantee the accuracy reliability or completeness of any information or calculations provided by this calculator.

This home affordability calculator provides a simple answer to the question How much house can I afford. The current economic environment has given us some of the lowest mortgage rates on record. To use our mortgage affordability calculator simply enter you and your partners income or your co-applicants income as well as your living costs and debt payments.

The calculator helps determine how much you can afford based on your yearly incomealong with the income of anyone else purchasing a home with you and your monthly expenses. The calculator can estimate your living expenses if you dont know them. Simple calculations can help you determine your mortgage affordability.

The first steps in buying a house are ensuring you can afford to pay at least 5 of the purchase price of the home as a down payment and determining your budget. You must still be able to afford your mortgage payments if your interest rate increases to the greater of. Enter a value between 0 and 5000000.

If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000. With these numbers youll be able to calculate how much you can afford to borrow. Tools to help you choose a bank account and credit card including budget and mortgage calculators.

The mortgage stress test was introduced on January 1st 2018 to evaluate if a borrower can withstand interest rate increases on their mortgage. The above calculation is a rough estimate based on your income and the Government of Canadas 5-year stress test rate necessary for qualifying. Your down payment can limit the above amount in various ways.

Applying for a mortgage making prepayments renewing your mortgage and more. This calculator is for illustrative purposes only. Use the TD Mortgage Affordability Calculator to determine a comfortable mortgage loan and price range for your new home.

This calculator steps you through the process of finding out how much you can borrow. For an accurate assessment please complete a pre-approval. Use the mortgage calculator affordability calculator and debt service GDS and TDS calculator.

The calculator also shows how much money and how many years you can save by making prepayments. Compare your monthly debt payments and housing expenses to your gross. Enter a value between 001 and 25.

This tool does not include mortgage loan insurance when you have a down payment of 20 or more or when the property value is 1 million or more. Canada Mortgage Qualification Calculator. Its a prudent measure implemented by the government to ensure that Canadas housing market stays stable.

So if you make a 20 down payment this means you gain 20 equity of your home. But like any estimate its based on some rounded numbers and rules of thumb. We estimate you could afford a home worth up to.

For homes that cost over 1000000 the minimum down payment is 20. Compare rates payment frequency amortization and more to find your best mortgage options. CMHC is not be liable for loss or damage of any kind arising from the use of this tool.

Affordability calculators need to take into account government stress testing regulations published by the Office of the Superintendent of Financial Institutions OSFI. For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first 500000 plus 10 of the remaining balance. Our Mortgage Affordability Calculator applies the federal lending rules most lenders use in assessing mortgage.

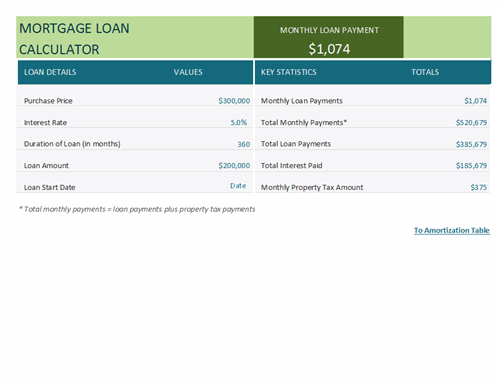

Your annual household income. Combined amount of income the borrowers receive before taxes and other deductions in one year. This calculator determines your mortgage payment and provides you with a mortgage payment schedule.

You can calculate home equity by taking the homes value and subtracting the amount you owe on your mortgage. The minimum down payment is 5 for the first 500000 10 for the portion of the house price above 500000 up to 1 million dollars and 20 for any house price over 1 million dollars. To get the most accurate result make sure to indicate all of the figures for your monthly expenditures.

Calculate how much I can borrow. Calculate your mortgage payment schedule and how to save money by making prepayments. Even though you are qualified for 57064472 based on your income but your down payment 2000000 20 is limiting your affordability to 10000000 of home value.

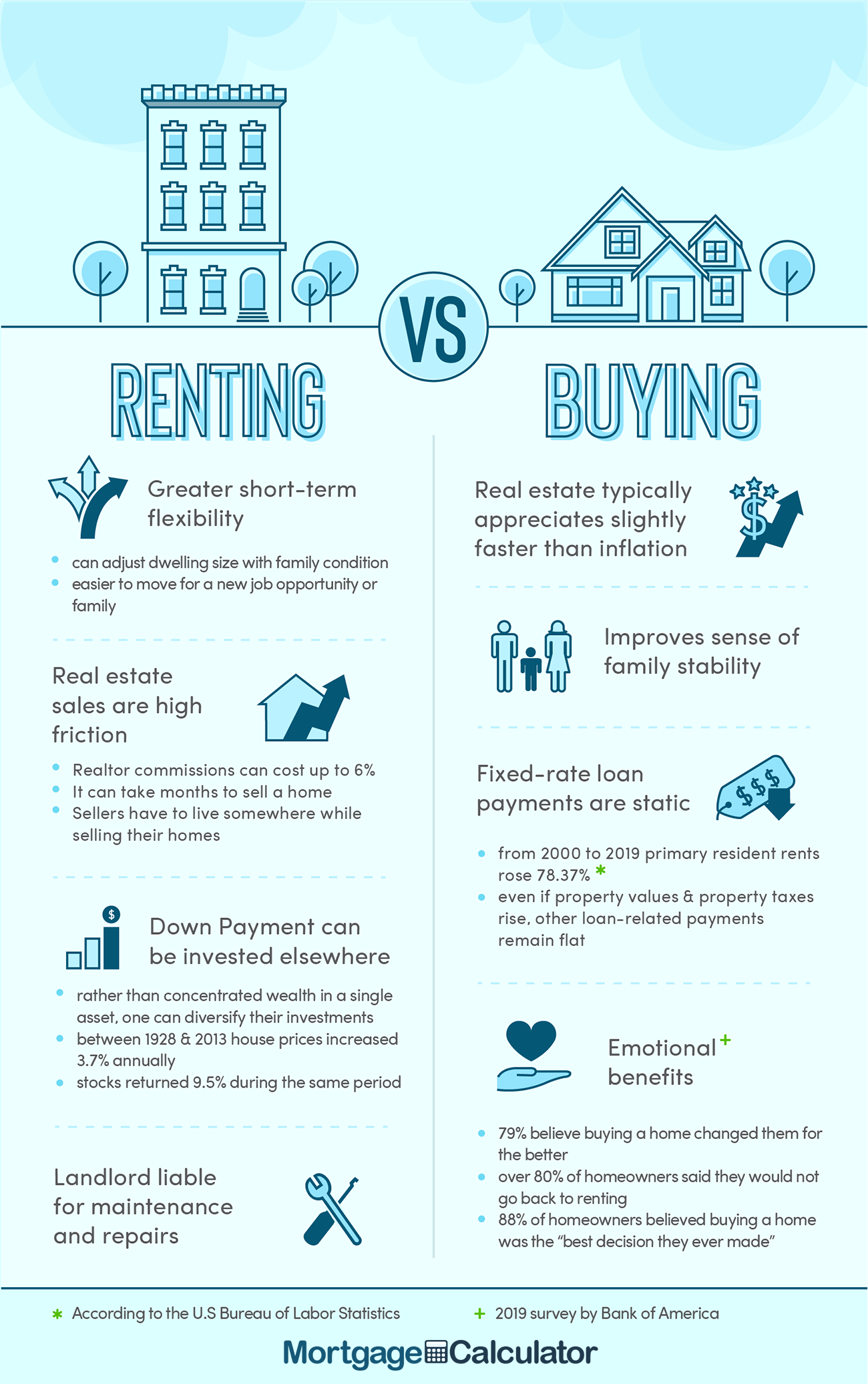

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. For down payments of less than 20 home buyers are required to purchase mortgage default insurance. In Canada people generally cannot keep a house during bankruptcy if they have a lot of home equity.

The Bank of Canada five-year benchmark rate of. 525 effective June 1st and.

A Few Factors For Home Loan Comparison In India Home Loans Loan Saving Money

Mortgage Calculator Excel Mortgage Calculator Template With Amortization Schedule And Extra Mortgage Amortization Mortgage Loan Calculator Mortgage Calculator

Pin On Estimate My Mortgage Payment

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Margagerate Calculator Realestateadvisor Realestateagents Realestatebroker Canada Gunjan Mortgage Loan Calculator Mortgage Loans Loan Calculator

Mortgage Payment Calculator Canada Estimate Monthly Ca Home Loan Repayments

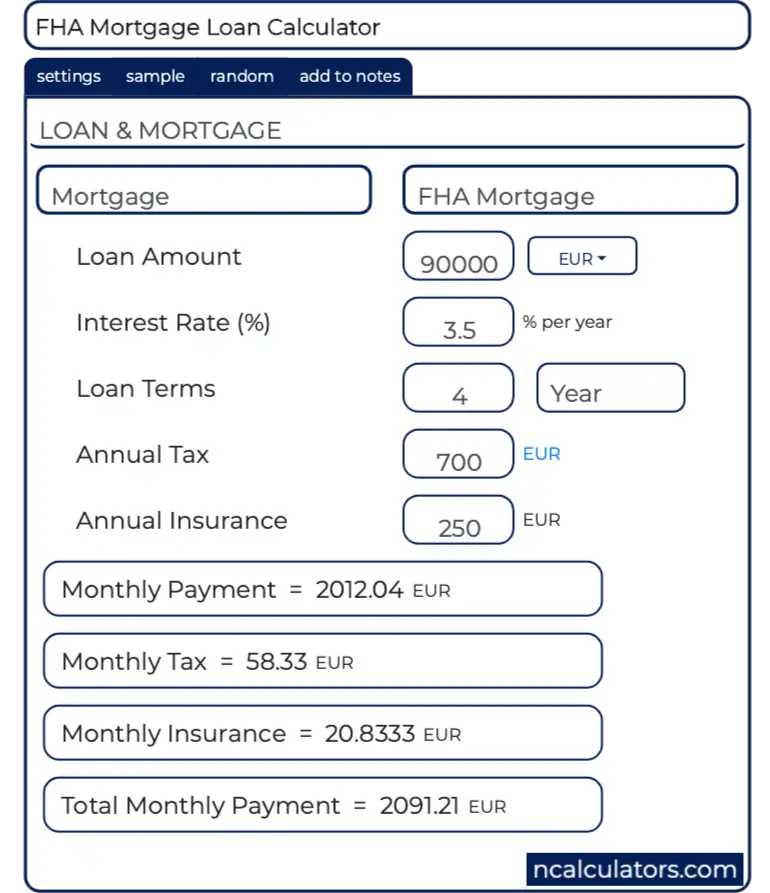

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Do You Want A Successful Timely Closing Once You Apply Be Sure To Avoid These Top 10 Mortgage Mistakes Dur Mortgage Tips Refinance Mortgage Mortgage Payoff

How To Rebalance Your Portfolio Thestreet Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

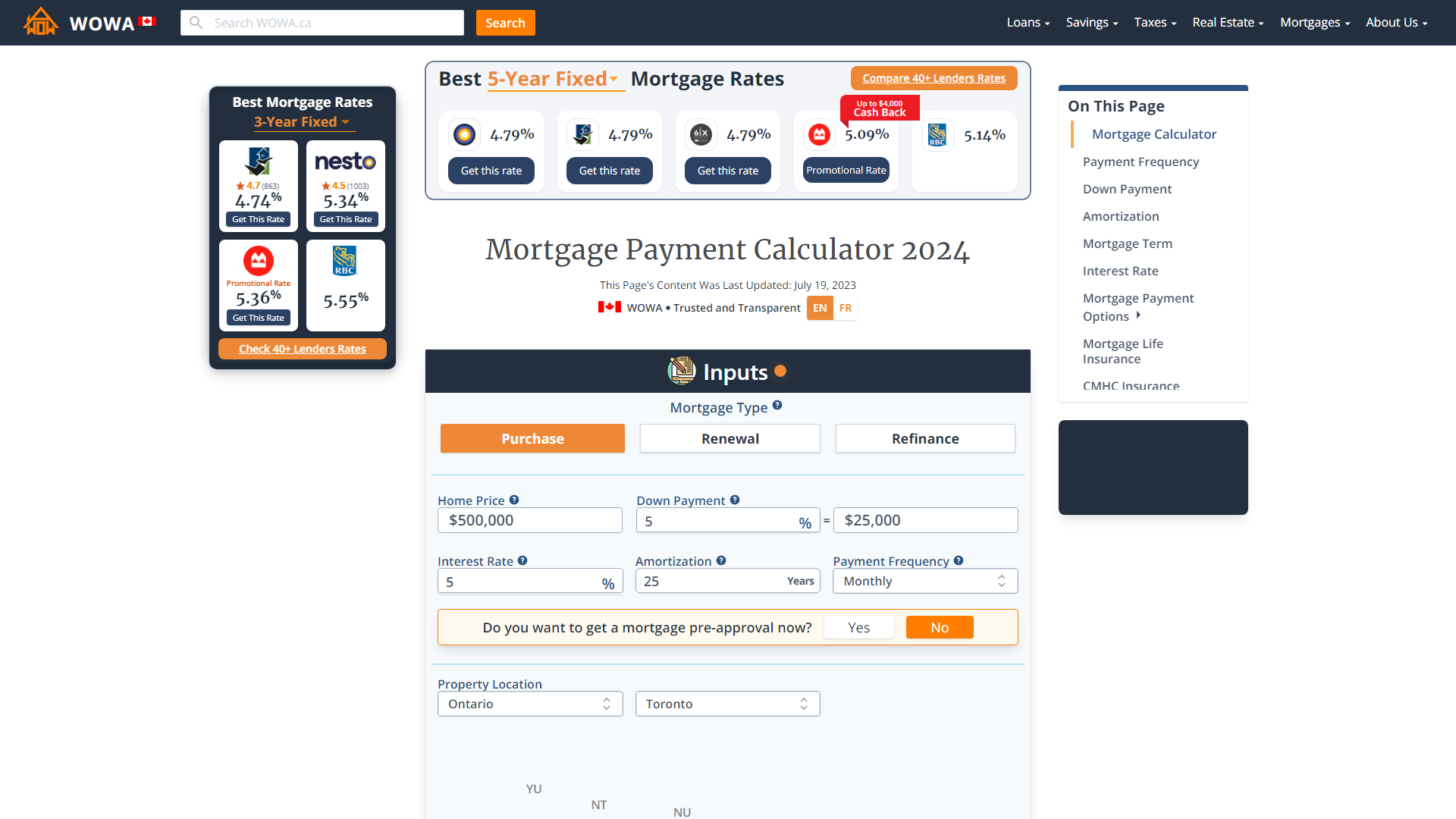

Mortgage Affordability Calculator Based On New Cmhc 2021 Rules Wowa Ca

Buying A Second Property Td Canada Trust

Mortgage Payment Calculator For All Canadian Provinces Wowa Ca

Mortgage Affordability Calculator 2021

![]()

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Mortgage Calculator Mortgage Calculator Canada Calculate Mortgage Payment Calculate Y Mortgage Payment Calculator Mortgage Payment Mortgage Loan Calculator

Biweekly Mortgage Calculator Biweekly Mortgage Calculator Biweekly Mortgage Mortgage Loan Calculator

Post a Comment for "Mortgage Affordability Calculator Government Of Canada"